Get the latest news in the July 2020 Ed Powers Newsletter Real Estate Update

For the complete July 2020 Newsletter Click here

Newsletter Content Index:

Thinking of Investing in Rentals With Others?

![]() Investing in rental property is a way for many to take advantage of monthly cash flow while seeing the asset increase in value over time. There really isn’t any type of investment that provides both benefits as rental property can. That’s why many diversify their portfolios to include real estate. However, sometimes it can be a bit expensive to come up with the necessary down payment and closing costs as well as identify a property that will cash flow each month. With rates still flirting with record lows, now might be as good a time as ever to make the leap and purchase your very first property. Some real estate investors like to partner with others to spread the risk around a bit while at the same time being

Investing in rental property is a way for many to take advantage of monthly cash flow while seeing the asset increase in value over time. There really isn’t any type of investment that provides both benefits as rental property can. That’s why many diversify their portfolios to include real estate. However, sometimes it can be a bit expensive to come up with the necessary down payment and closing costs as well as identify a property that will cash flow each month. With rates still flirting with record lows, now might be as good a time as ever to make the leap and purchase your very first property. Some real estate investors like to partner with others to spread the risk around a bit while at the same time being

able to afford a property that might just be out of reach. Think of a fourplex or an apartment building. If you’re thinking of investing in real estate with others, there are some things you CONTINUED >>>

Home Equity Lines Of Credit On The Rise…But Can You Qualify?

The Coronavirus quarantine has you thinking about making upgrades to your home, and that has you thinking about tapping your equity to take out as a home equity loan (HELOC), right? If so, you’re part of a real estate trend that’s sweeping the nation right now.

A new report from LendingTree found that, “While the total number of home equity loan applications has fallen since January…those who do apply for a home equity loan are more likely to use it to pay for home improvements than they might’ve been at the start of the year.”

Across the nation’s 50 largest metro areas, “An average of 45.9% of home equity loans are being used to make home improvements,” they said. That’s up from 37.3% in CONTINUED >>>

What Will Homes Look Like In A Post-pandemic World?

Better family gathering space. More comfortable bedroom space. Peaceful and private outdoor space. If those items tick your preferred “quarantine home” boxes, we get it.

The truth is that being stuck at home—in a home you don’t necessarily love—stinks. So, we don’t blame you if, while you’ve been sheltering, you’ve been dreaming of what you would change and where you would move given the choice.

The good news is that this pandemic is already having an impact on how builders operate, and the very things that are frustrating you about your existing home will likely drive changes to design and architecture in the future.

“While the coronavirus still rages on, it’s hard to predict what post-pandemic abodes might look like,” said Barrons. “Yet, developers around the U.S. are already rethinking projects, anticipating residents’ needs and CONTINUED >>>

How To Support Anti-racism With Your Home Buying Or Homeowner Dollars

The country was rocked by the murder of George Floyd on May 26, and protests have been erupting all over the world ever since. In the aftermath of Floyd’s death, many companies have spoken out to decry racism and commit their dollars—and their activism—to equality.

In that vein, we’re posting a list of companies who have been outspoken in their support of racial equality. For the purpose of this article, we’re focusing on those that are in some way related to buying or selling a home, renovating, decorating, and even celebrating a purchase or home-related milestone. But you can track corporate donations and see a growing list of companies across nearly every type of industry who have taken a stand here.

This is not meant to be a comprehensive list, and we invite you to add anyone we missed in the comments.

Look to your lender Choosing between financial institutions for a purchase or refi? “Bank of America pledged $1 billion over four years to help communities across the country address economic and racial inequality and said the commitment

CONTINUED >>>

Read about the events shaping the Real Estate market today, find current interest rates, or browse the extensive library of advice and how-to articles written by some of the top experts in Real Estate. Updated each weekday.

More Articles

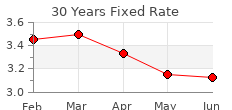

Mortgage Rates

U.S. averages as of July 2020:

30 yr. fixed: 3.13%

15 yr. fixed: 2.59%

5/1 yr. adj: 3.08%