The country was rocked by the murder of George Floyd on May 26, and protests have been erupting all over the world ever since. In the aftermath of Floyd’s death, many companies have spoken out to decry racism and commit their dollars—and their activism—to equality.

In that vein, we’re posting a list of companies who have been outspoken in their support of racial equality. For the purpose of this article, we’re focusing on those that are in some way related to buying or selling a home, renovating, decorating, and even celebrating a purchase or home-related milestone. But you can track corporate donations and see a growing list of companies across nearly every type of industry who have taken a stand here.

This is not meant to be a comprehensive list, and we invite you to add anyone we missed in the comments.

Look to your lender Choosing between financial institutions for a purchase or refi? “Bank of America pledged $1 billion over four years to help communities across the country address economic and racial inequality and said the commitment

CONTINUED >>>

June Real Estate Roundup

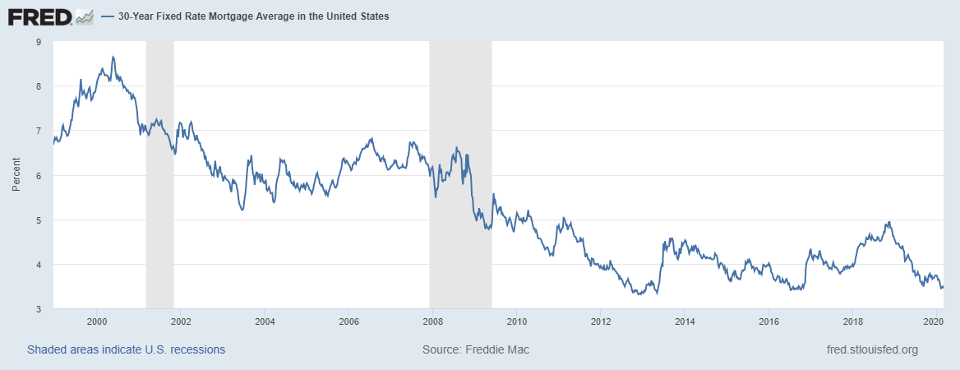

Mortgage Rates

U.S. averages as of July 2020:

30 yr. fixed: 3.13%

15 yr. fixed: 2.59%

5/1 yr. adj: 3.08%

Freddie Mac’s results of its Primary Mortgage Market Survey® shows that “After the Great Recession, it took more than ten years for purchase demand to rebound to pre-recession levels, but in this crisis, it took less than ten weeks. The rebound in purchase demand partly reflects deferred sales as well as continued interest from prospective buyers looking to take advantage of the low mortgage rate environment.”

• 30-year fixed-rate mortgage (FRM) averaged 3.13 percent with an average 0.8 points for the week ending June 25, 2020, down from last month when it averaged 3.15 percent. A year ago, at this time, the 30-year FRM averaged 3.73 percent.

• 15-year FRM this week averaged 2.59 percent with an average 0.8 points, down from last month when it also averaged 2.62 percent. A year ago, at this time, the 15-year FRM averaged 3.16 percent.

• 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.08 percent this week with an average 0.5 points, down from last month when it averaged 3.13 percent. A year ago, at this time, the 5-year ARM averaged 3.39 percent.

What Will Homes Look Like In A Post-pandemic World

Better family gathering space. More comfortable bedroom space. Peaceful and private outdoor space. If those items tick your preferred “quarantine home” boxes, we get it. Perhaps it is time to buy or sell your Fort Collins or Loveland home.

The truth is that being stuck at home—in a home you don’t necessarily love—stinks. So, we don’t blame you if, while you’ve been sheltering, you’ve been dreaming of what you would change and where you would move given the choice.

The good news is that this pandemic is already having an impact on how builders operate, and the very things that are frustrating you about your existing home will likely drive changes to design and architecture in the future.

“While the coronavirus still rages on, it’s hard to predict what post-pandemic abodes might look like,” said Barrons. “Yet, developers around the U.S. are already rethinking projects, anticipating residents’ needs and preferences that Covid-19 would spur. In doing so, they are re-evaluating current in-unit aesthetics and in-demand amenities.

That means a “new consumer” might have “different priorities from now on regarding health, technology and socialization,” Marcelo Kingston managing director of Multiplan, the developer behind 57 Ocean in Miami Beach, told them.

Home size

Homes had been trending smaller. But that may be over. With uncertainty about the future around spending more time in the home, which likely includes some form of work-from-home scenario, homeowners are likely looking for more space. Expect homes to grow in size accordingly.

A greater dependence on the home office

“More attention will be given to the arrangement of the workplace at home,” said Dezeen. “Spatial organization will change, with the place to work at home no longer a desk with a parody of an office chair and a lamp, slotted somewhere in the corner of the living room or under the stairs. Now it will be a completely separate room with large windows, blackout curtains and comfortable furniture. It will be technically equipped and sound-insulated.”

An increased emphasis on “health and hygiene”

This covers a wide variety of amenities.

“Joel Sanders of JSA Architects predicts that the pandemic, “like 9/11, will have an enormous impact on public space because of social distancing and fear of contamination,” said Dwell. “He foresees these concerns finding their way into the home, impacting space in more subtle ways, like the distancing of furniture arrangements and domestic footprints shifting to include “safe” rooms to isolate contagious occupants.

In addition, architects and designers foresee “a compartmentalization of spaces including entries, foyers, and mudrooms, incorporating sanitation stations to wash, disinfect, and remove contaminated clothing. This attention to sanitation, however, won’t necessarily give rise to sterile-looking environments. According to Bryan Young, principal of Young Projects, “Fundamental qualities of wellness are even more meaningful for adapting to a post-coronavirus environment, incorporating natural light, natural ventilation, connection to green spaces and landscape.”

This type of design will bleed into technology, as well. “We already have much of the technology we need to replace human contact with smart sensors,” said Stambol. “And in a post-pandemic world, nobody wants to touch anything unnecessarily. So, the low-hanging-fruit of design upgrades will be the first to change. Think of more touchless faucets and sensor-operated doors. Every doorknob, light switch, thermostat, and the high-traffic button will be swept away, replaced by motion activation or voice command. And every previous objection based on cost can be easily countered with memories of a global economic catastrophe.”

Smart technology

This is already one of the most pervasive trends in home design, but “Manufacturers of smart home systems will go one step further,” said Dezeen. “Their programs will not only control the temperature of the air in the house, but also its quality and, if necessary, they will automatically clean it. Air from the outside will of course be filtered.”

Message me if your thinking about buying or selling a Fort Collins or Loveland home at m.me/EdPowersRealEstate

Ed Powers Real Estate 970-690-3113 ed@EdPowersRealEstate.com www.EdPowersRealEstate.com

Thinking of Investing in Rentals With Others?

Investing in rental property is a way for many to take advantage of monthly cash flow while seeing the asset increase in value over time. There really isn’t any type of investment that provides both benefits as rental property can. That’s why many diversify their portfolios to include real estate. However, sometimes it can be a bit expensive to come up with the necessary down payment and closing costs as well as identify a property that will cash flow each month. With rates still flirting with record lows, now might be as good a time as ever to make the leap and purchase your very first property. Some real estate investors like to partner with others to spread the risk around a bit while at the same time being able to afford a property that might just be out of reach. Think of a fourplex or an apartment building. If you’re thinking of investing in real estate with others, there are some things you need to know.

When just two people buy a rental property, such as a husband and wife, lenders review the income and credit of each. Income and debts are added together to arrive at a proper debt ratio. As it relates to credit, lenders use the lower middle score of the two. Lenders will look at a credit report and scores from each of the three main repositories, Equifax, Experian and TransUnion. Of the three reported scores, the lender will use the lowest middle score of the applicants. When multiple parties are buying, a different approach is taken.

Each buyer will complete his or her own application. The lender then documents all parties in the same fashion. The buyers will provide copies of their most recent paycheck stubs covering a 30 day period. The last two years of W2s will be provided along with copies of bank and investment statements providing verification of sufficient cash to close the transaction. If there are five couples buying a rental property, you can already tell that’s going to be no small amount of paperwork. Each and every buyer must submit the proper paperwork.

However, the lender cannot proceed until all parties have submitted the necessary documentation. If there are 10 buyers and 9 have properly completed an application, nothing can go forward until that final person complies with the lender’s documentation request. You’re going to have to rely on everyone to get their paperwork in on time. Just one person can throw a monkey wrench in the plan.

Second, and this is just as important if not more so, credit reports and scores will be reviewed for each of the 10 applicants. Just like lenders underwrite a couple and using the lowest middle score of the two, lenders will identify the lowest middle score of the 10 applicants. If 9 people have scores above 740 and 1 has a score of 600, the lender will want to scrutinize the transaction a little further. In such an instance, that one remaining investor might want to pull out of the transaction allowing the purchase to go through. To avoid this possibility, all parties should pull an individual credit score on their own at www.annualcreditreport.com. This website is sponsored by all three credit repositories and allows consumers to get a free credit report each year.

Finally, there should be a person or two to monitor the application and facilitate the process as it moves along. If there is someone that is slow getting documentation in, that individual should be responsible for contacting the others letting that person know they’re slowing things down as well as keep all applicants up to date on the status of the loan.

It can be a good way to expand your portfolio by investing in real estate with others, just a bit more due diligence is required.

Message me if your thinking about buying a Fort Collins or Loveland home at m.me/EdPowersRealEstate

Ed Powers Real Estate 970-690-3113 ed@EdPowersRealEstate.com www.EdPowersRealEstate.com

Ed Powers Real Estate July 2020 Newsletter

Get the latest news in the July 2020 Ed Powers Newsletter Real Estate Update

For the complete July 2020 Newsletter Click here

Newsletter Content Index:

Thinking of Investing in Rentals With Others?

![]() Investing in rental property is a way for many to take advantage of monthly cash flow while seeing the asset increase in value over time. There really isn’t any type of investment that provides both benefits as rental property can. That’s why many diversify their portfolios to include real estate. However, sometimes it can be a bit expensive to come up with the necessary down payment and closing costs as well as identify a property that will cash flow each month. With rates still flirting with record lows, now might be as good a time as ever to make the leap and purchase your very first property. Some real estate investors like to partner with others to spread the risk around a bit while at the same time being

Investing in rental property is a way for many to take advantage of monthly cash flow while seeing the asset increase in value over time. There really isn’t any type of investment that provides both benefits as rental property can. That’s why many diversify their portfolios to include real estate. However, sometimes it can be a bit expensive to come up with the necessary down payment and closing costs as well as identify a property that will cash flow each month. With rates still flirting with record lows, now might be as good a time as ever to make the leap and purchase your very first property. Some real estate investors like to partner with others to spread the risk around a bit while at the same time being

able to afford a property that might just be out of reach. Think of a fourplex or an apartment building. If you’re thinking of investing in real estate with others, there are some things you CONTINUED >>>

Home Equity Lines Of Credit On The Rise…But Can You Qualify?

The Coronavirus quarantine has you thinking about making upgrades to your home, and that has you thinking about tapping your equity to take out as a home equity loan (HELOC), right? If so, you’re part of a real estate trend that’s sweeping the nation right now.

A new report from LendingTree found that, “While the total number of home equity loan applications has fallen since January…those who do apply for a home equity loan are more likely to use it to pay for home improvements than they might’ve been at the start of the year.”

Across the nation’s 50 largest metro areas, “An average of 45.9% of home equity loans are being used to make home improvements,” they said. That’s up from 37.3% in CONTINUED >>>

What Will Homes Look Like In A Post-pandemic World?

Better family gathering space. More comfortable bedroom space. Peaceful and private outdoor space. If those items tick your preferred “quarantine home” boxes, we get it.

The truth is that being stuck at home—in a home you don’t necessarily love—stinks. So, we don’t blame you if, while you’ve been sheltering, you’ve been dreaming of what you would change and where you would move given the choice.

The good news is that this pandemic is already having an impact on how builders operate, and the very things that are frustrating you about your existing home will likely drive changes to design and architecture in the future.

“While the coronavirus still rages on, it’s hard to predict what post-pandemic abodes might look like,” said Barrons. “Yet, developers around the U.S. are already rethinking projects, anticipating residents’ needs and CONTINUED >>>

How To Support Anti-racism With Your Home Buying Or Homeowner Dollars

The country was rocked by the murder of George Floyd on May 26, and protests have been erupting all over the world ever since. In the aftermath of Floyd’s death, many companies have spoken out to decry racism and commit their dollars—and their activism—to equality.

In that vein, we’re posting a list of companies who have been outspoken in their support of racial equality. For the purpose of this article, we’re focusing on those that are in some way related to buying or selling a home, renovating, decorating, and even celebrating a purchase or home-related milestone. But you can track corporate donations and see a growing list of companies across nearly every type of industry who have taken a stand here.

This is not meant to be a comprehensive list, and we invite you to add anyone we missed in the comments.

Look to your lender Choosing between financial institutions for a purchase or refi? “Bank of America pledged $1 billion over four years to help communities across the country address economic and racial inequality and said the commitment

CONTINUED >>>

Read about the events shaping the Real Estate market today, find current interest rates, or browse the extensive library of advice and how-to articles written by some of the top experts in Real Estate. Updated each weekday.

More Articles

Mortgage Rates

U.S. averages as of July 2020:

30 yr. fixed: 3.13%

15 yr. fixed: 2.59%

5/1 yr. adj: 3.08%