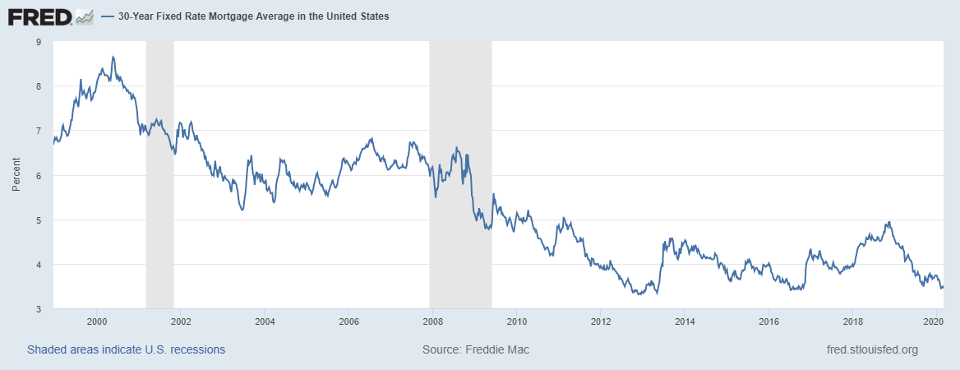

Should you be refinancing right now with sub-3% rates? Probably. But are there other ways to save on your mortgage that you might not know about? Definitely. A little-known mortgage payment trick could save you thousands over the life of your loan.

So what’s the big secret? Paying your mortgage twice per month.

We know what you’re thinking: “How does paying double save me money?” Let us explain. Paying twice per month doesn’t mean making the entire monthly payment twice. It means paying half of the total every two weeks.

“The practice is called bi-weekly mortgage payments, a strategy where mortgage loan customers pay their mortgage loan every two weeks, instead of once a month,” said Experian. “The idea is to chop down your mortgage payment more quickly, and in the process, lower the amount of interest you pay on your mortgage overall.”

So how does paying every two weeks cut down on your total amount and save you big time? When you pay monthly, you make 12 payments per year. Pay every two weeks, and you actually end up making 13 full payments. And that one extra payment is directed toward the loan’s principal.

“Since the homeowner is reducing the amount of the loan balance quicker, they are also reducing the amount of interest charged over the life of the loan,” said MortgageCalculator.org.

What to ask your lender

Before you start making that extra payment, you’ll want to make sure it’s allowed. Some lenders either don’t facilitate the process or don’t credit the payment more than one time per month. “Many lenders decide to hold partial payments in an account until the rest of it is received,” said MortgageCalculator.org.

Other companies may allow bi-weekly payments but charge a fee. “Rarely, some lenders will charge you to make biweekly payments, since it’s essentially twice as much work for them to process,” said Magnify Money. “If your lender does this, it may be better to stick with your normal monthly payment plan. If you want to make biweekly payments, you can still do so manually for free by setting aside a portion of your paycheck on your own, paying your normal monthly payment, and then submitting an extra payment once per year.”

How much can you save?

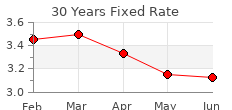

This scenario illustrates the type of long-term savings that make bi-weekly payments attractive. “Say you have a 30-year fixed-rate mortgage for $250,000 with a 4 percent interest rate. Your monthly payment would be about $1,194, and the total interest paid over the life of the loan would be $179,673,” said Bankrate. “In the same scenario, using a biweekly mortgage calculator, your total interest paid over the life of the loan on a biweekly plan is $150,450.40. That means you’d save more than $29,000, and pay off your loan in 25 years instead of 30.

Another alternative

If making a payment every two weeks isn’t feasible, consider a lump sum payment once a year. Maybe you get a Christmas bonus, a merit bonus, or a tax refund. Using this windfall and allocating the equivalent of one mortgage payment would make a huge dent in your principal. “By paying one extra payment of $1,285.33 each year” on a “25-year loan of $250,000 with interest at 3.75%…the loan amortization schedule with extra payments shows that you would repay the loan 2 years and 11 months earlier and save $17,381.35 in interest,” said Interest.com.

Message me if your thinking about buying or selling a Fort Collins or Loveland home at m.me/EdPowersRealEstate