Mortgage Rates

U.S. averages as of July 2020:

30 yr. fixed: 3.13%

15 yr. fixed: 2.59%

5/1 yr. adj: 3.08%

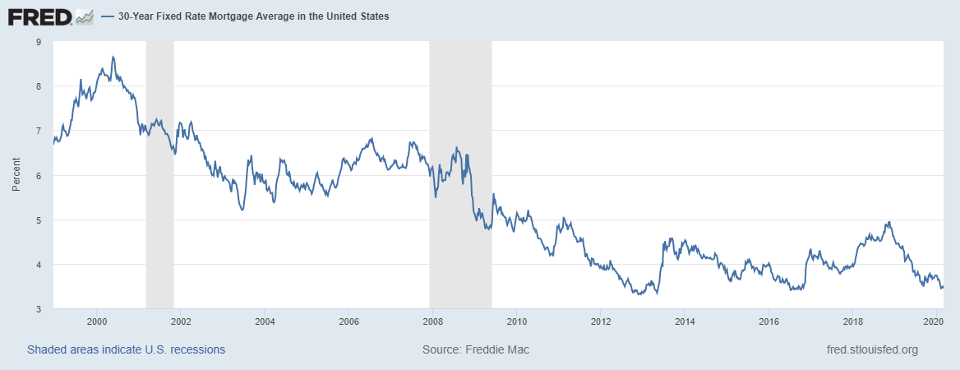

Freddie Mac’s results of its Primary Mortgage Market Survey® shows that “After the Great Recession, it took more than ten years for purchase demand to rebound to pre-recession levels, but in this crisis, it took less than ten weeks. The rebound in purchase demand partly reflects deferred sales as well as continued interest from prospective buyers looking to take advantage of the low mortgage rate environment.”

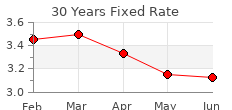

• 30-year fixed-rate mortgage (FRM) averaged 3.13 percent with an average 0.8 points for the week ending June 25, 2020, down from last month when it averaged 3.15 percent. A year ago, at this time, the 30-year FRM averaged 3.73 percent.

• 15-year FRM this week averaged 2.59 percent with an average 0.8 points, down from last month when it also averaged 2.62 percent. A year ago, at this time, the 15-year FRM averaged 3.16 percent.

• 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.08 percent this week with an average 0.5 points, down from last month when it averaged 3.13 percent. A year ago, at this time, the 5-year ARM averaged 3.39 percent.