Get the latest news in the October 2020 Ed Powers Newsletter Real Estate Update

For the complete April 2020 Newsletter Click here

Simple Ways to Start Investing in Real Estate in 2021

| Simple Ways to Start Investing in Real Estate in 2021 Buy REITs To invest in real estate, you don’t always have to buy property. There is something called a real estate investment trust or REIT. A REIT lets you invest in real estate, but you don’t have physical property. They’re a bit like mutual mutual funds, except with commercial real estate. For example, the company that makes up the REIT will own retail spaces or CONTINUED >>> |

New vs. Existing Homes: Which Should You Buy?

New vs. Existing Homes: Which Should You Buy? New vs. Existing Homes: Which Should You Buy?It used to be at one point that buying a new house was almost always going to be more expensive than an older house. Buying materials for new construction is less expensive now than in the past, so price alone isn’t necessarily a determinant or at least the primary determinant for many people. What Are the Upsides of Buying an Older House? Some of the benefits of buying an existing, older home might CONTINUED >>> |

6 Ways to Win a Bidding War A bidding war just means that a seller receives multiple offers within the same short window of time. It’s great from a seller’s perspective. They can wait around and see how much buyers are willing to sweeten the deal. It’s tough for a buyer. It means you’re probably going to pay more than you thought, and it’s stressful to be in limbo. The following are 6 tips to keep in mind to win a bidding war if you find yourself in that position. Get Pre-Approved by Your Lender One of the first things you should do if you’re going to be looking for CONTINUED >>> |

How to Handle Your Home Sale Falling Through

How to Handle Your Home Sale Falling Through Selling a home can be an emotional and stressful experience. Then, finally, you find a buyer and you feel a huge sense of relief. You’re ready to pack up and move on.

What happens if your contract doesn’t actually make it to closing, however?

It’s easy to feel defeated and emotionally pretty upset, but you can bounce back.

Understand Why It Fell Through One of the big things you need to do to move forward is get a handle on why your deal fell through. This is important so you can prevent it from happening again.

Contingencies are what protect a buyer from running into often unpleasant surprises.

A few reasons why home sales fall through include:

• A home inspector finds something that would be expensive for the buyer to repair.

• Your home appraises for less than the sale price.

• There’s an open lien on your property uncovered by a title search.

• Your buyer’s financing falls through.

Initially, if

CONTINUED >>>

Read about the events shaping the Real Estate market today, find current interest rates, or browse the extensive library of advice and how-to articles written by some of the top experts in Real Estate. Updated each weekday.

More Articles

| March Real Estate Roundup | |

| Everything You Should Know About Property Taxes | |

| Reasons to Refinance You May Not Know About | |

| APR Explained | |

| The Best Ways to Save Money on a Bathroom Remodel |

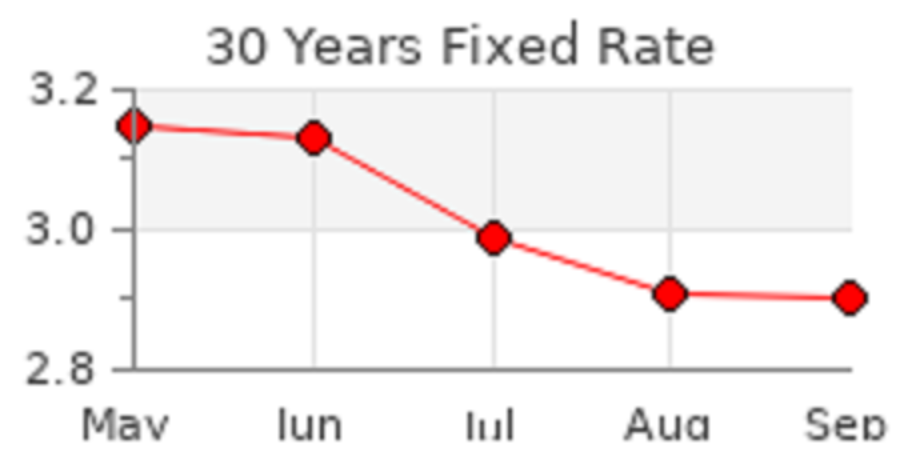

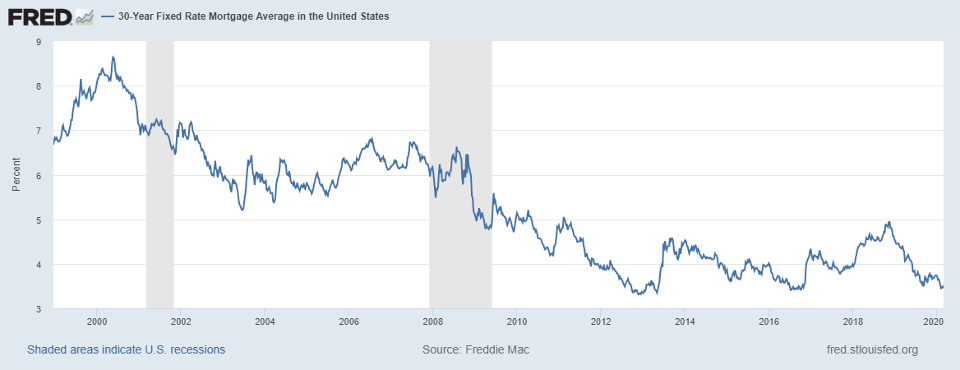

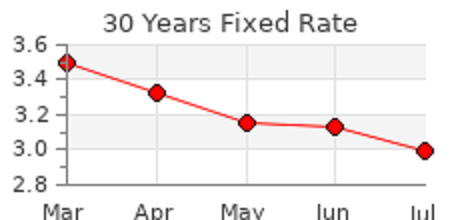

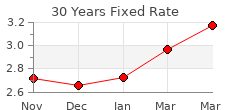

Mortgage Rates

U.S. averages as of April 2021:

30 yr. fixed: 3.17%

15 yr. fixed: 2.45%

5/1 yr. adj: 2.84%

Message me if your thinking about buying or selling a Fort Collins or Loveland home at m.me/EdPowersRealEstate